AI Job Loss Is Accelerating – and Washington Won’t Stop It

Editor’s note: “AI Job Loss Is Accelerating – and Washington Won’t Stop It” was previously published in January 2026 with the title, “CHAOS Economics: How to Survive and Thrive Amid the AI Job Collapse.” It has since been updated to include the most relevant information available.

For the past few years, the headlines have told one story.

The market’s near all-time highs. Corporate profits are booming. AI is minting millionaires in real time.

And yet…

Talk to your friends. Scroll LinkedIn. Look at your grocery receipt.

Something doesn’t feel right.

Mid-career professionals are “open to work” for months. Real wages feel stuck. Rent keeps climbing. The stock market says “prosperity,” but the real economy is voicing something else.

That disconnect is structural.

We have officially entered a new economic epoch, something academics call “structural adjustment” and doomers call “collapse.”

I call it CHAOS Economics.

In this new world, there are only two types of people: the serfs who work for the algorithm, and the lords who own it.

We are staring down the barrel of an AI-driven Engels’ Pause – an era when GDP rises but workers’ purchasing power remains flat as capitalists’ profits soar.

To put it bluntly, the Titanic has already hit the iceberg. And, much like on the Titanic, the band is still playing and the cocktails are still being served in first class – but the water is rising in steerage.

If you want to survive, it’s time to board the lifeboat…

The iceberg didn’t appear overnight. It’s been building for years, hidden below the surface.

Here’s what it looks like.

How AI Automation Creates Job Loss: The Two Forces Driving CHAOS Economics

We are witnessing the collision of two unstoppable forces moving in opposite directions.

Force 1: AI, the Deflationary Tsunami

Artificial intelligence is the single greatest deflationary force in human history; the ultimate cost-cutter.

We might have once expected robots to replace assembly line workers – and that’s still coming. Tech titans Amazon (AMZN), Tesla (TSLA), and China’s BYD have said they aim to use humanoid robots in their operations. Most recently, Hyundai – in partnership with Boston Dynamics – unveiled its humanoid robot, Atlas, designed to “ease physical strain on human workers” and “pave the way for wider use of the technology.” In our view, that’s corporate speak for “replace human workers”…

But right now, software is the more immediate threat. Before physical bots arrive at scale, AI software is already starting to replace once-high-status jobs: interpreters, proofreaders, code writers, logistics managers.

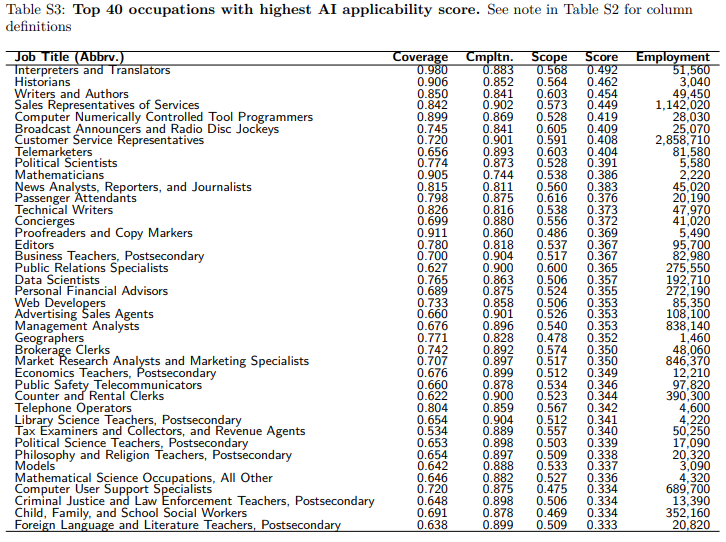

Microsoft’s late-2025 analysis of AI job exposure depicts a terrifying situation.

Management analysts, customer service reps, sales engineers… We are talking about 5 million white-collar jobs – the bedrock of the American tax base – facing extinction.

When a company can replace a $120,000-a-year mid-level manager with a $20-a-month subscription to an AI Agent, they don’t think about it. They just do it. It’s their fiduciary duty. This collapses wages and labor demand through “Technological Deflation.”

Force 2: The Inflationary Response

If everyone loses their job, the entire consumer economy collapses.

The government cannot allow a deflationary depression and risk 20%-plus unemployment turning into a revolution. So, it will do the only thing it knows how to do: print money.

The government will print cash by the trillions, calling it “stimulus,” then “relief,” until eventually, it’s just “universal basic income” (UBI).

This is a form of monetary dilution. Economists call this fiscal dominance. I call it “Currency Hallowing.”

And then comes the death spiral … where more job loss leads to more money printing, which leads to more job loss and more money printing, in an accelerating cycle.

This is CHAOS: Currency Hallowing And Overautomation Spiral.

Prices for things made by AI (software, media, digital entertainment) will crash to near zero. But prices for limited commodities (houses, land, food, energy, healthcare) will skyrocket because the dollar is being debased to fund the unemployed masses.

The result? A society where we have a supercomputer in our pockets, but we can’t afford a steak dinner.

AI Job Displacement Mirrors the Industrial Revolution

“But Luke,” the tech optimists might say. “Technology always creates more jobs than it destroys. Look at the tractor or the loom!“

To which I’d say: you’re ignoring Engels’ Pause, named after Friedrich Engels, the 19th-century economist who documented what happened when the Industrial Revolution collided with labor markets.

Between 1790 and 1840, Great Britain’s GDP growth rate exploded from 0.2% to 3.2% annually. Technology (steam engines) created massive efficiency gains. Corporate profits doubled, increasing by over 20% from the late 18th to the mid-19th century.

But here’s what Engels noted: while the Industrial Revolution was making Britain incredibly rich, most Brits saw their lives get much worse, not better.

For the average worker, real wages remained flat or fell for 50 years. Workers’ share of the national income dropped from 50% to 45%, even as total wealth soared. And in Manchester and Liverpool, life expectancy for working-class children fell to just 17 years.

The wealth did eventually trickle down… and the Industrial Revolution did eventually lead to more jobs… half a century later.

The weavers who lost their jobs to power looms didn’t become “machine repairmen.” They starved. They rioted and, often, were shot by the military or shipped to penal colonies. It took two full generations for the labor market to adjust.

We are entering an AI-driven Engels’ Pause. But this time it will be faster and more brutal.

The steam engine took a century to deploy. ChatGPT hit 100 million users in two months. We’re compressing 50 years of displacement into a single decade.

And the disruption isn’t just coming for low-skill manual labor this time. It’s coming for the accountant, the lawyer, the editor… It’s coming for you.

Government Won’t Stop AI Job Loss: The Political Race to AGI

By now you’re probably thinking: But won’t the government step in to regulate AI and protect Americans’ jobs?

Well, Washington is stepping in … just not in the way most people think.

The current administration controls the levers of power, and its platform can be summarized in three words: Go, Baby, Go.

The administration’s ‘One Rule’ executive order requires agencies to eliminate one regulation for every new rule imposed. It preempts state AI safety regulations in California and Colorado, blocking their enforcement. The goal is clear: Remove all friction. Let the companies build and deploy.

The reason? China. The geopolitical reality is that if we slow down to protect jobs, China reaches Artificial General Intelligence (AGI) first. And to Washington, winning the AI Cold War matters infinitely more than your 401(k).

You may have heard murmurings about a new government “AI framework” in development…

Behind the scenes, agencies are being mobilized for the Genesis Mission: a Manhattan Project-scale initiative to dominate the next wave of AI, nuclear, and advanced manufacturing.

Think of it as a government-backed AI production program, with hard deadlines, big money, and regulatory fast-tracking.

The government has cut the brake lines and is flooring the accelerator because it’s terrified that if it doesn’t, Beijing wins the race to AGI.

This means there will be no meaningful AI regulation or ‘Human Employment Protection Act.’ We are barreling toward the cliff edge of labor obsolescence at maximum velocity, sanctioned by the State.

The Data Proving AI Is Replacing Workers Right Now

Look at the data from late 2025.

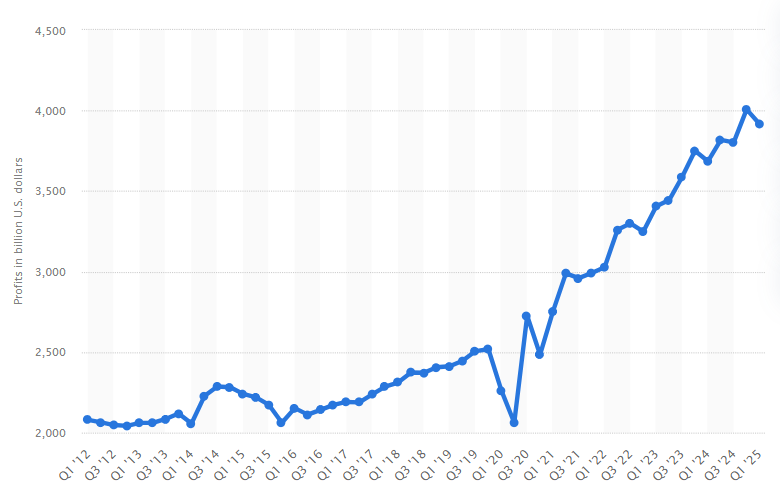

The S&P 500 was soaring, with corporate profits at record highs.

Meanwhile… Unemployment has risen to 4.6% – and climbing. Consumer sentiment has collapsed to 51 (on the University of Michigan’s index), nearly matching the all-time low of 50 hit during peak inflation in June 2022. Real wage growth is getting squeezed. And layoff announcements have soared, topping 1.1 million in 2025 – the highest since the COVID-19 pandemic.

This disconnect – the “Rich Economy, Poor People” vibe – is the iceberg. And we’ve already hit it.

The structural damage is done, and the water is pouring in.

The Old American Dream was built in the steerage class of this ship, on the premise that your labor had inherent, growing value. It assumed that if you showed up and did a good job, the market would reward you with a middle-class life.

But that premise is dead.

In a CHAOS economy, selling your time for money is a losing trade. Your time and the currency you’re paid in are both depreciating in value, faster every quarter. It’s like running on a treadmill spinning backward – and accelerating.

If you stay in the “labor class,” you sink with the ship.

How to Protect Your Job from AI: The Only 3 Investment Strategies That Work

So, what do you do? Curl up and wait for the UBI check that buys you a loaf of bread and a VR headset?

No. If the world is splitting into “techno-feudal lords” and “serfs,” you make damn sure you’re sitting at the high table.

The only way to win in CHAOS Economics is to join the capital class.

This requires a fundamental shift in how you think about money. You cannot save your way out of a currency devaluation spiral. You must think about “owning the machine.”

If AI is stealing jobs, you must own AI companies. If tech giants are capturing GDP, you must own their equity. And if the grid powers everything, you must own the infrastructure.

This isn’t about “diversification” or a nice, balanced 60/40 portfolio. Bonds are garbage in a currency hallowing environment. Cash is trash. Even most stocks are value traps.

You need a lifeboat. And in 2026, the only seaworthy vessel is high-growth AI equity.

Here’s your survival roadmap:

The Infrastructure

The AI arms race is expensive. It requires chips, data centers, and an unprecedented amount of energy. Nvidia (NVDA), AMD (AMD), and Taiwan Semiconductor (TSM) aren’t just stocks – they’re tolls on the future. Nobody builds the future without paying them.

But infrastructure goes deeper. AI data centers are ravenous for power – they need baseload energy that solar and wind can’t deliver. Nuclear power plants and utilities providers are the unsexy infrastructure that will power this revolution.

These companies will print money. Own them.

The Sovereigns

Stop looking at Microsoft, Alphabet (GOOGL), Meta (META), and Amazon as companies. They are more like nation-states. Microsoft’s R&D budget exceeds $25 billion annually – larger than NASA’s. They own the data, the customers, and the platforms.

In a feudal system, you want to be aligned with the strongest king. These companies will survive the CHAOS, swallowing competitors and extracting rents from every transaction in the digital economy. You want equity in their monopolies.

The Agents

This is the “hypergrowth” corner – the highest risk, highest reward tier where 100x returns are possible. Look for software companies building the AI agents that replace $200/hour lawyers and $150/hour architects.

If your profession is being automated, you need to own stock in the company doing the automating. It’s the only way to hedge your personal balance sheet against your own obsolescence.

Your Window Is Closing

This sounds uncomfortably dark because it is.

The “Help Wanted” signs are disappearing. The rent prices are rising while wages stall.

The Engels’ Pause is here. The gap between the Haves (capital owners) and the Have-Nots (labor) is about to widen into a chasm.

You have a brief window of time – perhaps 12 to 24 months – before the rest of the world realizes the ship is sinking. Right now, they’re still in the ballroom, seemingly unaware of any impending doom.

They don’t see the CHAOS. But you do.

It’s time to get in the lifeboat.

You can’t stop the flood – but you can ride the current.

The single most powerful wealth strategy in a CHAOS economy is to move with the capital flows that Washington unleashes. Every modern fortune – from wartime steel to internet infrastructure – started with government contracts.

We’re seeing it again right now.

The U.S. government is now stepping in as the largest activist investor on Earth – taking equity stakes, backing strategic supply chains, and directly funding the industries it considers mission-critical.

When those deals surface, the market reacts in less than no time.

I’ve put together a full briefing on this “President’s Market” – and how investors can position before the next wave of government-backed buying goes public.

If CHAOS Economics is the storm… This is how you sail to safety.